Chapter 15 - Financing the Single-Family Residence

Learning Objectives

At the completion of this chapter, students will be able to do the following:

1) Explain the difference between conventional loans and FHA insured loans.

2) Explain the difference between PMI and MIP.

3) List at least four types of loans that a homeowner may receive.

4) Discuss the difference between a pre-qualification letter and a pre-approval letter.

15.1 Lender Considerations

Transcript

You know that as a real estate agent the goal of buying and selling properties revolves around finding long-lasting homes for your buyers. For other parties in the process, such as the sellers and lenders, the goal is to turn a profit.

Often, agents deal with the financial side of things more often than not. Their sellers want to know how much the home will sell for, while their buyers want to get the best price on the property. However, these factors are not just based on the current market condition or the whims of buyers. Rather, they are based on how lenders react to the transactions.

Real estate agents need to be able to explain to their home buyers and even sellers that lenders play a significant role in the entire process. This includes in determining how much a buyer can offer or how much a seller must list his or her home for sale.

Right now, we’ll talk about lender considerations. It’s just what its name sounds like. What do lenders consider and weigh before making decisions about who to lend to and how much to lend? And, we’ll talk about how lenders turn a profit.

Lenders are always seeking an investment in their borrowers.

That’s perhaps the most important piece of communication you can relay to your home borrowers about lenders. They look at this transaction as an investment opportunity. It’s not necessarily about whether or not the Smith family really deserves a home. It may seem cold, but it’s simply a business transaction.

What Are Lenders Looking For?

When lenders provide borrowers with a loan, they want to ensure they are making a wise investment. This investment must balance the risk with the profit margins lenders set. The simplest explanation of how a lender profits is through interest rates. This is a fee charged to the borrower for borrowing the money. However, other fees are involved as well.

Ultimately, the lender has to decide whether or not to hand over $200,000, or any sum, to a person who wishes to buy a home. They don’t want to provide that loan to someone who will not be able to repay the debt.

How do they make this decision, then?

The lender must weigh the yield they will receive, or the profit, compared to the amount of risk they are taking on. The yield is their return. Any investor in any industry wants to know how much a particular investment is going to yield them, or help them earn. Anyone in any type of investment process does the same thing. How much risk are they willing to take to achieve their goals?

When you look at it from this point of view, then it also provides insight into the cost of interest. Investors in the stock market often understand that the high-risk stocks have the biggest potential for creating profits for them, if they are successful. High risk equals high potential reward. Conversely, these high-risk stocks also present the most incidents in which the company will fail and they will lose money.

In the world of home loans, the lender balances the same type of risk. Here, high-risk borrowers are going to pay much higher interest rates than those who are safer, low-risk borrowers. Those high interest rates definitely present a bigger potential profit for the lender. However, they also have the most likelihood of failing.

Now, back to the question at hand. How do they determine how much risk a particular borrower presents?

That’s done by analyzing the creditworthiness of a borrower. Just how likely is this borrower to make payments, on time, and to continue on with the loan for the entire length of the loan? Since there’s no way to see in the future, lenders must base this off of the borrower’s previous borrowing habits. This is done through credit scores. Higher credit scores indicate the borrower has already made payments on time and managed credit wisely.

What factors determine a borrower’s credit score?

- Do they make payments on time to all of their credit cards and personal loans?

- Do they take on a lot of debt? Do they have a lot of debt?

- Do they have ample history of borrowing and repaying on time?

Third-party providers determine credit scores. However, every lender determines what score is acceptable to meet their borrowing requirements.

How Do Lenders Make Money?

As mentioned previously, the main method lenders make a profit on home loans is through interest. Interest is applied over time on the home loan. With each payment, a portion of the payment goes to the principal (or borrowed amount) while another portion goes towards paying interest.

Lenders also make money on loans through origination fees. These are fees charged at the time that the loan is obtained. This fee is charged by the home loan lender at the point of entering into the loan agreement. It covers all of the costs associated with securing the loan.

How Is Interest Determined?

While origination fees are a profit-point for lenders, most often, interest creates the bulk of the profit margin for the lender. How much interest is charged is the big question.

Many times, home buyers believe lenders, or more specifically, the person on the phone they are talking to, has the ability to set any rate they want to for the borrower. That’s not the case. Many factors play a role in how much the lender charges in interest. Let’s take a closer look at what factors matter.

The Term of the Loan: This is the length of time that the loan is in place for. Most commonly, borrowers take out 15 to 30-year loans. Other options range from 7 years and up to 40 years in some cases. The longer the term on a home loan, the higher the interest rate. That makes sense. The lender will maintain the same level of risk for a longer period of time.

The Type of Loan: The second factor in determining where the interest rate will be is the type of loan obtained. A wide range of options exist, but one key factor here is whether the rate will adjust. Fixed rate and adjustable rate loans are available. Fixed rate loans create an even payment for the borrower throughout the loan term because the same level of interest is applied from start to finish. Adjustable rate loans will adjust over time, based on key lending rates. Most adjustable rate mortgages offer super low intro rates but can adjust upwards throughout the length of the loan. Fixed rate loans offer a constant interest rate that tends to be low to moderate. Adjustable rate loans often start lower and grow.

The Loan Amount: Next is the consideration for the loan amount. The higher the loan amount is, the more the buyer is going to pay in interest rates. The lender is facing more risk because it’s investing more money into the borrower. Bigger loans have higher interest rates.

The Lender’s Cost to Borrow Money: This is the key interest rate set by the Federal Reserve. It is the amount of interest banks charge each other to borrow, or move money back and forth. This is generally the base rate from which interest rates charged to borrowers will go up from.

As a real estate agent, what is your role in lender considerations?

You cannot tell your home buyer what the lender will offer them. This is a complex algorithm with many moving parts. As an agent, you can help buyers understand why they are paying what they are and what motivates a lender to offer a more attractive rate.

Lenders aren’t heartless, but they are making a valuable business decision. That’s why it is so important for buyers to offer their best credit scores and credit management skills, while also weighing carefully which house is right for them.

Key Terms

Yield

The interest earned by an investor on an investment (or by a bank on money it has loaned). Also, called return.

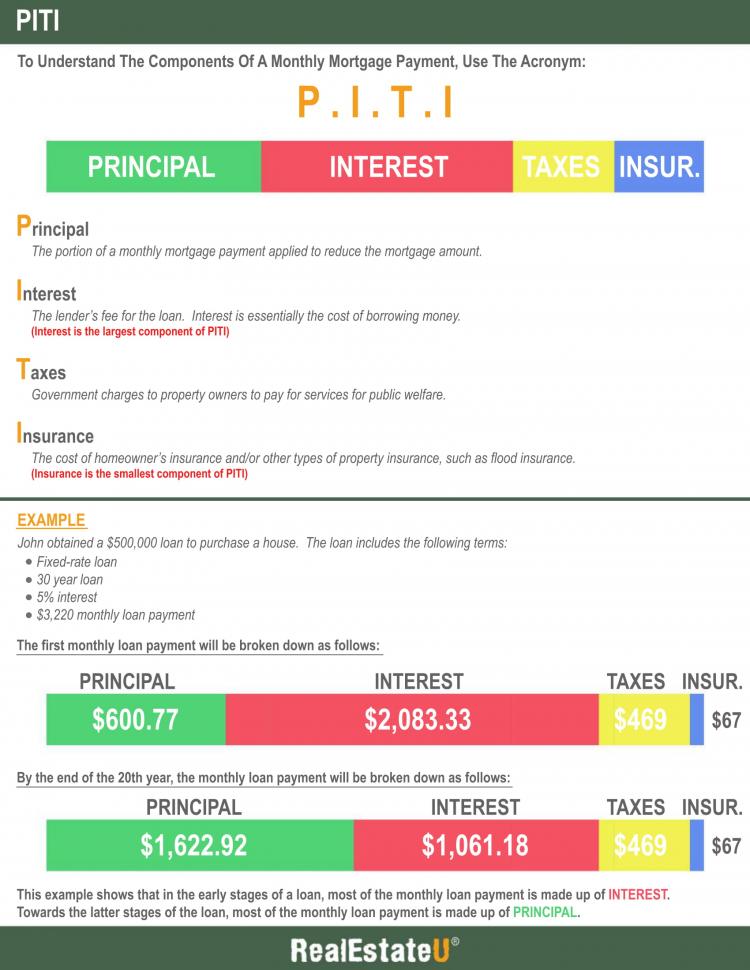

15.1a PITI Infographic

Please spend a few minutes reviewing the Infographic below.

15.2 Conventional Loans

Transcript

It’s inevitable that, from time to time, a home buyer will walk into your real estate office and proclaim they want to buy a home. But, in that same breath, they’ll ask you, as their real estate agent, how to pay for it. Of course, agents are not responsible and rarely should give advice about the financial aspect of the transaction. However, today’s home buyer will often rely on their agent’s direction and influence. It goes without saying, then, that agents should understand the value in the financial arena, surrounding loans.

While there are various loan programs available, at the heart of the options is the conventional loan. As its name implies, this is the basic loan format, the most commonly used option and one of the many vehicles your home buyer will have available to him or her during the buying process. Before getting into the details of these loans, it is important to consider the experience your home buyers have, at this point.

Many home buyers will come to real estate agents after hearing about fantastic loan programs, discount options, and super low-priced interest rates. And, sometimes, home buyers will want their agent to explain it all. It is important to remember that you should recommend your clients to a financial expert who can provide them with the proper advice, when it comes to their mortgage and financing. However, you will have to be knowledgeable enough to be able to explain the main concepts and what they stand for.

For that point, view conventional loans as the starting point. Depending on various scenarios, a home buyer may qualify for other forms of financing such as an FHA loan or VA loan (more on those in another lesson!) However, it’s impossible not to explain what conventional loans are without talking about the opposite version. FHA and VA loans are government backed loans. A home buyer may apply for a loan and receive financial backing from a government agency, reducing risk to the lender. Conventional loans do not have this type of financial backing.

For the purpose of this lesson, our goal is to breakdown the conventional loan structure.

So, What Are Conventional Loans?

These are financial loans given by banks and other financial institutions to borrowers for the purchase of a home. Conventional loans are neither issued nor guaranteed by any federal agency or the government. Should the borrower default, unlike other types of loan offers, these loans present no promise to the lender for financial help. As a result of this, lenders will require stricter financial requirements.

Now, home lenders set their own terms. Some are more willing to offer lower prices or fewer requirements for a down payment. Generally speaking, most conventional loan lenders hedge the risk of having no government backing by requiring a 20 percent down payment on the home purchase. Additionally, borrowers must also pay for private mortgage insurance, commonly called PMI.

There are very strict guidelines in place for conventional loan lending. These are established by the Federal National Mortgage Association (Fannie Mae) as well as the Federal Home Loan Mortgage Corporation (Freddie Mac). These loans are available to most people applying for a home loan. However, unlike government-backed loans, they are harder to qualify for, because of more stringent qualification requirements.

Without any type of federal backing, conventional loans are a higher risk to lenders. For that reason, they often require a higher credit score for home buyers. They also will need to demonstrate they have a steady income. Also, it is important for home buyers to have a down payment they can afford. Considering these factors, the loans are not always for everyone.

How Can a Home Buyer Obtain a Conventional Loan?

Generally, any mortgage lender will offer conventional loans. A home buyer will need to demonstrate their ability to meet the requirements of these loans. When a home buyer meets with his or her lender, the mortgage agent will work with them to determine if they qualify for this loan and, if not, what other potential loan programs may be available to meet their needs. This is often done after an initial application is accepted by the lender from the borrower.

In nearly all cases, you can simply instruct your home buyers to apply for a loan through their preferred home loan lender. Then, the lender will process the application and present the buyer with options that fit their credit qualifications. If they do not qualify for a conventional loan, the lender may present other options. This is generally done within a matter of hours to a day or so. As an agent, you’ll want to make sure your home buyers have completed this prior to looking for homes to purchase. You can use this information to determine how much of a home they can afford.

Why Would a Home Buyer Want to Use a Conventional Loan?

There are advantages to conventional loans. First, in some cases, conventional loans can be more affordable from the viewpoint of a home seller. With FHA loans and other government-backed loan programs, the federal agency will place restrictions on what the homeowner can buy. For example, a home will need to pass safety inspections and a lead [lead = toxic poisoning] screening. These requirements can slow down the home purchase process.

Secondly, conventional home loan borrowers have to have a much larger down payment. They are generally well-qualified buyers. From the seller’s viewpoint, they are a more likely purchase the property. For this reason, home buyers should view conventional loans as a good investment and even a negotiating tool.

Conventional loan interest rates can be just as good as FHA or other government-backed loans for the right buyer. However, home buyers will want to examine all options prior to investing.

Now let’s talk about another factor that can play a role in the availability of a conventional loan and the process of obtaining them. It’s the Loan to Value Ratio or LTV.

The loan to value ratio is an important tool for lenders to consider when assessing the amount of risk a borrower presents to the lender. It is always used when determining if a lender should provide a loan for the purchase of a home or any type of real estate. This is done before the mortgage approval is processed. In short, the more expensive the home, the more risk the lender has to manage.

As its name implies, this is a calculation of how much risk is present when considering the amount of the loan requested, compared to the value of the home. When there is a high LTV, that means there is more risk to the lender than a lower LTV. LTV is important for several reasons. Most importantly, if a lender feels the LTV is too high, the lender will require the borrower to obtain mortgage insurance. This somewhat help reduce the risk.

But, before getting into private mortgage insurance, let’s talk more about the calculation of LTV. It is possible to find a number of LTV calculators online. These are okay for the average home buyer to use and get an idea of what the LTV will be on any home they purchase.

Lenders will base LTV on the appraised value of the home, or the sale price of the home, whichever of the two is less. To calculate the LTV you have to take the loan amount and divided it by the sale price, or appraised value. Here’s an example of what this looks like. Let’s say a home buyer wants to purchase a home that is appraised at $100,000. The home buyer will provide a $20,000 down payment, which means he is borrowing $80,000. The LTV is then 80,000/100,000, or 80 percent in this case.

This information is very important for the lender. The person working with the home buyer – often a mortgage agent – has to present the loan to the underwriters. The underwriters of the loan will then determine if there is too much risk to provide this person with a loan. When this value is higher, there is less likelihood of that approval taking place.

Conventional loans require 20 percent down payment to reduce the LTV. However, even after that 20 percent, some home buyers may still be too much of a risk through this loan opportunity and the underwriter may decide the loan is too risk.

Fannie Mae and Freddie Mac currently have a 97 percent LTV on mortgages. This means that, in some cases, a homeowner can qualify for the loan with just a three percent down payment. This type of acceptance is often only available to those who have a very high credit score. Additionally, it is important to recognize that borrowers who do not have high credit scores may be better served with a government-backed loan such as an FHA loan.

Now, How Does Private Mortgage Insurance Work?

Private mortgage insurance, or PMI, is often a requirement for all conventional loans because of the high risk involved in these loans. PMI is a type of insurance product that protects the lender, not the home buyer.

It works by providing the mortgage lender with reimbursement up to a certain level for the home loan if the home buyer defaults on the loan. This type of insurance only pays the lender if and when the home itself is not worth enough to pay the lender for the total amount lost, if the home must go through the foreclosure process.

PMI is nearly always a requirement whenever a homebuyer purchases a home with less than 20 percent down payment. It may also be required when the home buyer is obtaining a conventional loan because of the lack of security the lender has when the home loan is not a federally backed loan.

Now, home buyers may cringe at the need to pay PMI. In fact, many times the home buyers do not know what this is, how it works, or why they have to pay it. As an agent, you may receive questions about PMI, because it is always spelled out thoroughly in the closing documents and the loan documents that your home buyer will have, at the time of being approved for a home loan purchase.

Another important factor to consider is the length of time the PMI is required for. Most of the time, home buyers will not have to maintain PMI long term. It can be canceled down the road, after the home buyer has proven that they will make their mortgage payments on time. How and when the lender will agree to the reduction and elimination of the PMI requirement depends on the lender’s requirements and their decision about the borrower’s qualifications.

In the meantime, home buyers should expect to pay, in addition to their home loan payment, between one-half percent and one percent of the mortgage loan. This is paid to a servicing company each month. In nearly all cases, the lender will establish that the loan payment and the PMI payment be collected at the same time. The borrower does not pay PMI directly to the servicing company but rather to the lender each month.

How Should You Approach Conventional Loan Questions from Your Home Buyers?

Conventional loans remain a staple in the financial tools available to home buyers. Are they the best option for every home buyer? No, that’s not at all the case. Rather, conventional loans are often best for those who may not otherwise qualify for government-backed loans and those with very good credit scores and qualifications. They also should have a 20 percent down payment available to qualify for the lower LTV that Freddie Mac and Fannie Mae allow.

It's also important to know that loan requirements and conditions will change over time as policy changes. As a real estate agent, you may not be able to provide financial advice to your home buyer but you should be able to explain to them what the different options are as well as what they should do to obtain the loan they are looking for. And, of course, you also want to be sure your borrower has a loan in place, before moving forward with the home search.

Key Terms

Conventional Loan

A mortgage securing a loan made by investors without governmental underwriting, i.e., which is not FHA insured or VA guaranteed. This type of loan is customarily made by a bank or savings and loan association.

Loan to Value Ratio (LTV)

The percentage of a property’s value that a lender can or may loan to a borrower.

Private Mortgage Insurance (PMI)

Mortgage guaranty insurance available to conventional lenders on the first, high risk portion of a loan.

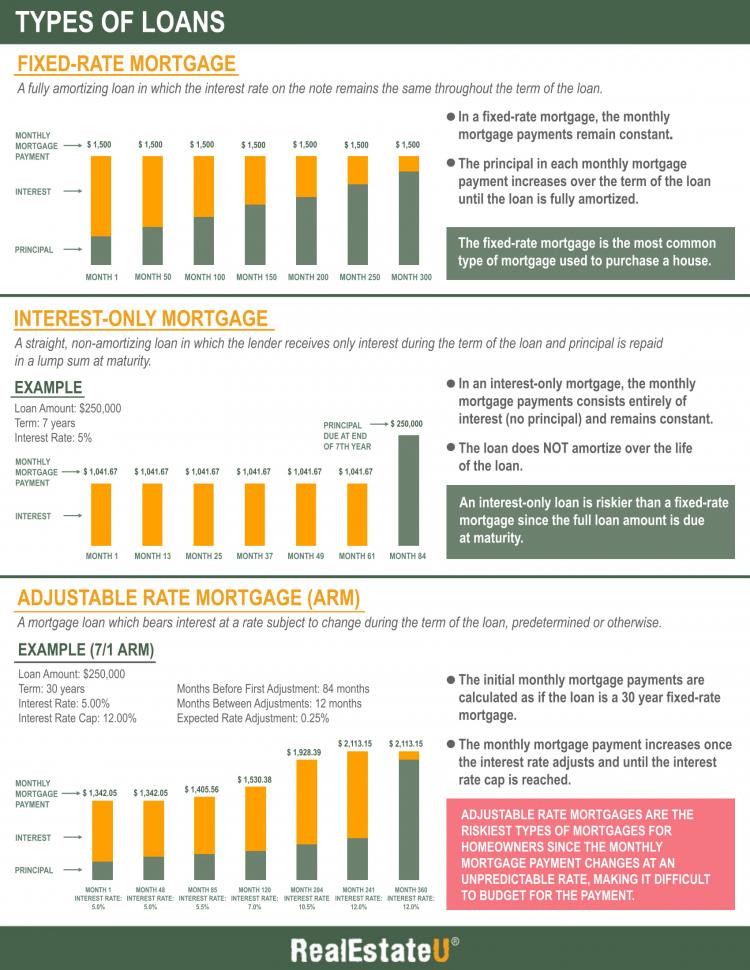

15.2a Types of Loans Infographic

Please spend a few minutes reviewing the Infographic below.

15.3 FHA Insured Loans

Transcript

If you were a real estate agent in the early 2000's, you would know much about FHA insured loans. These loans have long been sought after by today’s home buyers because of the many benefits they offer. As an agent today, the requirements for these loans are a bit more stringent than they used to be, but these loans still aid in helping to support the dream of homeownership in the United States. You’ll need to understand what these loans are and who they are good for. Also learn a few more details that can help you encourage buyers to look towards these loans.

One of the reasons to do just that is because of the ease of qualifying for these loans. Many of today’s first-time homebuyers want to buy a home but lack information about the availability of loans. Those without down payments, limited experience, and moderate credit shouldn’t be turned away from your service. Rather, encourage these potential home buyers to seek out FHA loans.

So, What Are FHA Insured Loans?

An FHA loan is a type of mortgage. It is not issued by the Federal Housing Administration – but it is insured by the organization. Any lender that offers this type of loan must meet specific qualifications. These loans were first created in the 1930's as a way to help individuals struggling through the Great Depression to get back into homeownership. During this time, the number of foreclosures rose drastically, making it necessary for the government to offer loans with fewer requirements.

The goal of an FHA loan is to provide access to home lending by those who may not otherwise qualify. Because lenders cannot afford to take on what they deem as high-risk loans, FHA loans help to reduce some of that risk. If a home buyer obtains an FHA loan and defaults on it, the federal government covers some of those losses, limiting the impact on the lender.

These loans offer some key benefits including lower interest rates. Because the federal government insures these loans, the lender is facing less risk. As a result, they are more willing to offer loans at a lower rate. By the same token, there are fewer other requirements as well. Credit qualifications are reduced. Home buyers do not have to have a high down payment either.

Now, what is the difference between an FHA loan and a conventional loan?

As we’ve noted so far, these loans have a number of reduced requirements. Conventional loans typically require a 20 percent down payment. Here, that’s reduced to 3.5 percent for an FHA loan. Conventional loans also have a higher credit score requirement. Home buyers need to have a credit score of at least 580 for an FHA loan, but for a conventional loan, this is typically at least 620. However, every lender has different requirements. Additionally, it may be possible to purchase a home with an FHA loan if a credit score is even as low as 500 if they have a larger down payment (of at least 10 percent).

From a real estate agent’s point of view, this is important. When interest rates and down payment requirements are lower, it may mean that your home buyer can qualify for a higher priced home. That’s because their monthly payment will still remain within reach with the significantly lower interest rates.

Considering this, you’ll want to understand more about how these loans work and when they can apply to the potential home buyer standing in your office ready to buy.

Let’s consider the Types of FHA Loans Available

FHA loans are available for many types of property as long as the buyer lives in it. In other words, it does not apply to rental property. FHA loans are available as 15-year loans or 30-year loans. Legally, they are not available for longer than 30 years.

What Are the Requirements for an FHA Loan?

We’ve touched on a few of these previously, but for clarity let’s outline what the specific requirements for an FHA loan are. This is one of the first questions your home buyers will ask you when they inquire about purchasing a home and you recommend this loan. It’s also important to note that these rules can change from year to year. They can be updated by the Congress from time to time.

First, there’s the minimum credit score requirement we’ve already mentioned. Those with a credit score of at least 580 should consider applying for a home loan. For those with a score under this, even as low as 500, it is still possible to obtain a loan with 10 percent down. To qualify under this secondary requirement, the loan to value ratio must be at 90 percent or less. That means the home loan must be at least 10 percent higher than the amount borrowed.

Next is the down payment requirement. A down payment helps to reduce the lender’s risk and it is always best for borrowers to put down the highest amount possible since it reduces how much they will end up financing through the loan. With FHA loans, borrowers should have at least 3.5 percent down.

There is also a requirement that individuals be a first time home buyer. However, this isn’t as clear-cut as it may seem. Obviously, those who have never purchased a home through a home mortgage will qualify in this area. If the home buyer owned a home previously and if they have not maintained a loan in the last three years, they may still qualify. If they have not been a primary borrower, they might qualify. Additionally, if one spouse has owned a home but the other spouse has not, they can still obtain an FHA loan. Another qualification occurs when a divorce occurs and the individual has divorced. Those who own a mobile home or an RV, it is still possible that they could be considered first time home buyers, as long as the property is not permanently attached to a foundation.

FHA loans also take into consideration income. However, it does not have a specific dollar amount attached to it. Rather, FHA looks at the debt to income ratio of the borrower. That must be no more than 43 percent. That means the amount of debt they have should not be more than 43 percent of their income.

There are other qualifications as well. For example, individuals will need to have a credit report clear of all delinquencies. Those who have not made payments on loans previously, or those who have unpaid debt to child support, or back taxes, may not qualify.

What Are They Buying?

As noted previously, FHA also wants to know what type of home is being purchased. It wants to ensure the home is safe and worth the value of the home sale price. This is another area in which conventional loans and FHA loans differ. With conventional loans, there’s less focus on the safety of the property and more focus on the value.

The FHA requires the home to meet specific safety, security, and soundness standards. When the homeowner decides to buy a home, a full FHA inspection will be necessary. This is a bit more thorough than the average house inspection because it looks at factors such as whether the property is pest and mold-free, has safety railings in place, and is lead-free. If there are concerns, they may need to be repaired prior to the lender approving the loan.

The type of home plays a role in whether or not a person can qualify for an FHA loan. The home must be the primary residence of the borrower. It must be owner-occupied. It can be used for most types of homes, including detached and semi-detached houses, row homes, condominiums, townhomes, and others.

What about Mortgage Insurance?

Like with most conventional loans, mortgage insurance premiums are required on FHA loans. This is 1.75 percent of the loan amount borrowed and it is paid up-front. However, most home buyers will roll this amount into the mortgage. In doing so, your home buyer does not have to have this amount available at the time of their home purchase. This insurance is a bit more expensive than what is paid through conventional loans which require private mortgage insurance. Also important is that, unlike conventional loans and private mortgage insurance, FHA loan borrowers must pay mortgage insurance premium coverage for the life of the loan.

When your home buyer walks in and tells you he or she does not have much of a down payment and their credit history isn’t the best, point them in the direction of FHA loans. Though not everyone will qualify, many people who are already paying high rental costs will find these loans much more accessible than conventional loans. That doesn’t mean everyone should buy a home – they still need to be able to afford it. Yet, FHA loans help to make it more likely that the home is in good condition, the borrower has the means to pay, and the property is affordable to them.

Key Terms

FHA-Insured Loan

A mortgage loan in which payments are insured by the Federal Housing Administration.

Mortgage Insurance Premium (MIP)

The amount paid by a mortgagor for mortgage insurance on an FHA-insured loan.

15.4 VA Guaranteed Loans

Transcript

Real estate agents work with all types of home buyers. One of the most honoring of all clients to help is the veteran. It’s likely that you will want to do all you can to help them to find the ideal home for their needs. Whether they are Active Duty or Retired or even Reserves, you’ll feel good about helping them to find a home.

However, before you can do that, you need to make sure they have the finances they need in place. Many Veterans are highly knowledgeable about the benefits they have available to them, but they may not recognize the benefits and features of VA loans. In short, Veterans Affairs Department home loans provide a financial opportunity to those who have served in the Armed Forces of the United States with a federally-backed mortgage. As a real estate agent, you need to be able to explain to your home buyer exactly what these loans are, how they work, and most importantly, how to choose a home that fits the sometimes stringent requirements for them. Let’s take a look at what you can expect from these home buyers.

What is the VA Loan Program?

The United States Department of Veterans Affairs provides individuals who have served in the Armed Forces and their families with the ability to obtain affordable, easier access to a home mortgage loan. The loans themselves do not come from the VA. Rather, like FHA loans, VA loans are backed by this agency, or more clearly, the federal government.

These loans are highly lucrative. If you have an individual who has served the country and is actively involved or honorably discharged, you’ll likely want them to consider the use of a VA loan. Chances are they will qualify for a larger loan at a much lower cost than if they selected any other type of mortgage. The VA has established specific requirements for those who wish to use this mortgage loan program, and that is where it can get complicated from a real estate agent’s view.

How Can Veterans Qualify for a Veterans Affairs Loan?

To obtain a VA loan, individuals must meet specific eligibility requirements. The first step is to obtain a Certificate of Eligibility, or COE. This comes directly from the Veterans Affairs Office. In short, it verifies that the individual has served in the Armed Forces, currently actively serving or has been honorably discharged, and has served enough time to earn credit.

The most complex process here is determining eligibility. Individuals who have the status of Active Duty will be able to obtain a VA loan in most cases based on the duration of their time served. For those who are discharged, it is important to consider how long the individual served. Those serving during times of war will need to spend less time in the military than those who did not serve during this timeframe. Additionally, those who are National Reserves can still qualify, depending on the length of time they have been a part of the program as well as if they’ve ever been activated.

As a real estate agent, it is nearly always best for you to direct your home buyers to the VA office to obtain the COE as a first step. From there, they can begin to talk to mortgage lenders about the availability of these loans and their credit qualifications.

Also, these loans are available to Veterans, active-duty personnel, National Guard members, Reserve members, and some surviving spouses (depending on the amount of time the individual served during the marriage).

What Are the Benefits of a VA Loan?

So, what makes these loans so beneficial? This is where it is important to understand what your home buyers have available to them.

First, VA loans allow for 100 percent financing. That means that home buyers do not have to have a down payment to purchase a home using a VA loan. This is a very big benefit for many home buyers and is especially beneficial to those who are buying their first home. Some lenders may still offer better interest rates and terms to those who do have a down payment, and of course, having a down payment reduces the overall cost to buy a home.

Next, the interest rate for VA loans is typically lower. With less risk, because these loans are backed by the federal government, lenders offer significantly lower interest rates for these loans. Remember, having lower interest rates also means your home buyer may qualify for a higher priced home.

VA home loans also have limits on closing costs. And, the VA funding fee charged on these loans can be rolled into the loan itself, reducing the amount of out-of-pocket expense the home buyer has. Closing costs are generally lower and may be paid by the seller. Also, there is no requirement for private mortgage insurance premiums to be paid, which is unlike FHA or conventional loans. Again, this is another savings opportunity for the Veterans.

The loans are also assumable, which means that, depending on the requirements of the lender, it is possible for these loans to be assumed by others, should they decide to sell the property. This too is different from most conventional and FHA loans.

The bottom line is that Veterans Affair loans cost less than most other types of loans, have fewer credit requirements, and do not require a down payment. This allows Veterans to enter into the home buying process sooner.

The VA loan does not have a maximum borrowing limit. However, lenders can limit the amount and size of the loan based on credit qualifications. If the lender is willing to offer a loan the VA will not limit what he or she can buy, up to the value of the home.

How Do Home Buyers Obtain a VA Loan?

You have a highly interested home buyer in your office. You know they’ve served in the military. What do you do next?

The first step for any individual is to obtain the COE from the VA office. Until this is in hand, the lenders cannot provide a loan to the buyer. And, that means you will not know what loan amount they can obtain.

The next step is to find a lender. Most mortgage lenders will offer VA loans, but the Department of Veterans Affairs will require the lender to be approved through them. The VA can provide some recommendations, but most credit unions and banks offer these loans. Most local mortgage lenders are also available.

Once they begin working with their lender, the home buyer can begin to work with you. The goal here is to ensure that the home buyer is pre-approved for the loan and that you know how much of a home they can afford to purchase. Remember, the VA backs the loan but does not provide it. The lender still makes the determination of whether they want to lend to the individual and how much he or she can borrow.

Like FHA loans, VA loans do have some minimum standards for the home itself. For example, the home must meet safety and health standards. This becomes evident during the home inspection. You can expect your home buyers to need a home inspection. Factors like lead paint and missing safety railings will need to be handled prior to approval of the sale. This is not much different than the process for an FHA loan.

If you have a buyer in your office that has served the country, thank them!

Then, encourage them to see out a VA loan. While they can buy with any other loan the VA loans tend to be the best option for most of today’s buyers. And, then, you can start helping them to find a home that meets their needs within the guidelines set by their lender.

Key Terms

VA Guaranteed Loan

A loan made to qualified veterans for the purchase of real property wherein the Department of Veteran’s Affairs guarantees the lender payment of the mortgage.

15.5 Other Types of Financing

Transcript

When you decided to become a real estate agent, you probably didn’t think you would have to spend much time learning about the financial components to real estate buying. But, in fact, you should know as much as possible about the financial side of this process. Often, you’ll find home buyers who need special types of loans or they may come to you with loans already in place on homes they want you to sell. You’ll need to understand how they work to ensure you can help them to complete the transaction in the best way possible.

What you probably expect is that there are numerous types of loans outside of conventional financing, FHA loans, and VA loans. You’re right. Here, we’ll take a look at a variety of other types of loans as they relate to real estate. Of course, you may not deal with these loans on a daily basis, but being knowledgeable about them is pretty critical when it comes to your career.

What Are Purchase Money Mortgages?

One type of transaction that occurs in some areas more frequently than others is a purchase money mortgage, also known as owner financing. You may encounter this type of loan in situations where the home buyer cannot qualify for a typical mortgage loan. In this situation, the loan is issued to the home buyer by the seller of the property. It is a component of the purchase transaction. The home buyer typically provides the seller with a down payment on the purchase. The seller may obtain a credit report of the buyer and he or she sets the terms of the financing. Often, the qualifications for a purchase money mortgage will be easier to qualify for with reduced credit requirements.

Some of these loans will incorporate various financing options such as interest-only loans, fixed rate terms, and other configurations. The two parties agree on the amount the purchase will be, the interest rate paid, and the amortization method. Down payment amounts are negotiable. Another key benefit of this type of financing is that there are fewer closing costs. Without an institutional lender, there are fewer administration fees. More so, there’s less time delayed in the application process. Both sellers and buyers can move through the purchase process faster.

This doesn’t change the requirements of the real estate agent’s job. He or she will continue to manage the transaction process and will still charge a fee. The agent doesn’t handle the legalities of the process but can negotiate terms for the buyer to some level.

It’s important to know that sellers also benefit from these loans when they can afford to provide them. The seller will collect the interest charged, which can be profitable, with the right buyer. Legally, a contract defines the process and the deed changes hands only when the final payment is made or when the buyer refinances the loan.

What Is an Installment Land Sales Contract?

An installment land sales contract, which is often called a land contract, and sometimes termed as articles of agreement, is a legally binding contract that is made between the home seller and the buyer. The home buyer agrees to make payments that include the purchase price of the home along with interest payments, over a set amount of time.

In this situation, the buyer takes possession of the home once the contract is put into place. However, the home seller will hold the legal title to the property until the contract terms are met. It is an alternative way to purchase a home, and again is an option best for those who cannot obtain a traditional loan. Of course, sellers benefit as well, if they can afford to sell a home in this manner, because it allows them to collect on the interest.

A key difference in installment contracts compared to a traditional mortgage loan is in the way in which defaults are handled. In a traditional mortgage loan, the lender goes through the legal foreclosure process to force the sale of a home. Most of the time, installment contracts will have a forfeiture clause. This allows the seller to end the contract at any point in which the buyer stops making payments (according to the terms of the contract) and allows the seller to regain possession of the property. It also allows for the seller to keep all payments previously made to the seller.

Installment contracts allow sellers to regain control over the property quickly, giving the home buyer less protection. There is also no right of redemption once this occurs, meaning the home buyer loses all interest in the property when any type of breach in the contract occurs. For most home buyers, this is the most difficult component of these financing options.

Lease-Purchase and Lease-Option – Another Type of Alternate Financing

Lease-purchase and lease-option are two additional options. These are commonly referred to as lease-to-own agreements. Both are a bit different and both can be beneficial in some situations. The agreements, as their names imply, allow a person who potentially will purchase a home to live within the home – while the seller maintains ownership of it, for a period of time.

The lease-purchase option has two separate contracts. The first is a type of tenant lease that provides the buyer with the ability to live in the home for a specific amount of time. The second component is an obligation defining specific goals for both the buyer and seller to define the sale of the property. The buyer is contracted to purchase the property as defined in the document. After a set amount of time, the buyer owns the property. In these conditions, the seller maintains ownership of the home.

In a lease-option, which is very similar, the tenant is able to ultimately purchase the property but does not have to sign a contract for sale at the time of entering into the agreement. Instead, he or she enters into what is called an option agreement. That is, the buyer is a tenant and occupies the property. The seller maintains the ownership of the property. However, the tenant maintains the right to buy the property at a specifically agreed upon price during the lease term in exchange for a fee that’s pay to the seller (which is often called an option fee).

In all situations, the buyer in these situations is on the hook for maintaining the property and making payments as the contract requires. And, if they fail to do so, the buyer loses his or her ability to buy the home. Throughout the time they live there, they have the same types of rights as a tenant in a rental property. Nevertheless, this type of arrangement can work well for some buyers who don’t have a down payment or credit history.

Real estate agents don’t want to enter into these agreements, most commonly, since no sale is taking place right away. And, it’s important for agents to be able to explain the risks to the home buyer in these situations.

What Is a Second Mortgage?

Also called a junior lien and sometimes interchangeable with a home equity loan, a second mortgage is a type of property-secured loan taken out on the portion of a home that’s not under mortgage.

For example, if a homeowner owns a home valued at $200,000 and has a current mortgage in place with a balance of $125,000, he or she has about $75,000 worth of equity available. This equity can be borrowed against using a secondary loan, or second mortgage.

Homeowners can take out a second mortgage for many reasons. Some do so because it provides a low-interest way to do home improvements or make larger investments. Some use the funds from a second mortgage to consolidate debt. This is a big risk, though, since most types of unsecured debt such as credit cards can be easily wiped clean during bankruptcy. However, by paying it off with a secured loan, the homeowner’s unsecured credit debt now becomes secured by their home’s value. And, like with a first mortgage, lenders can pursue foreclosure if loan payments are not made on time.

Second mortgages offer benefits to homeowners because they tend to be significantly less expensive in terms of interest and annual percentage rates. However, these loans still carry legal consequences. It’s also important to know that, when a home is defaulted on and foreclosed on by the lender, first mortgage debt is repaid first. If there are not enough funds from the sale to cover a second mortgage, the homeowner remains responsible for repaying the debt.

As a real estate agent, second mortgages are not commonly something you’ll have to worry about unless a home seller has two loans on the property you hope to sell for them. In this case, the home’s sale price generally will need to be high enough to cover both mortgage values. Nevertheless, a second loan does not complicate the sale process for an agent.

What Are Blanket Mortgages?

A blanket mortgage or loan is a type of financing agreement in which the party is able to use a single transaction to purchase more than one piece of real estate. This type of financial instrument is commonly used with builders and developers who plan to purchase a large amount of land and then divide it among several locations. The loan allows for the developer to sell off a portion of the property, called a parcel, when necessary, such as when a home is built.

Like traditional mortgage loans, blanket loans will still use the land as collateral for the loan. However, each of the individual parcels of land can be sold off without paying off the entire mortgage each time this occurs.

Without the use of a blanket loan, a property buyer – most of the time a developer – would have to purchase a large tract of land with individual loans for each parcel. That’s not very feasible in terms of cost and origination. Instead, a blanket mortgage allows the property owner to sell off a parcel at a time over a longer period of time, while the mortgage lender still maintains the ability to foreclose on the property if the debt is not paid off in time.

Some real estate agents work hand-in-hand with developers and property builders. When this is the case, it may become necessary to understand the terms of a blanket mortgage. A key factor here is that when a home is built and purchased by the ultimate home buyer, the property is no longer under the blanket mortgage. The sale of that property is paid towards the portion of the mortgage covering that land. That means that the ultimate home buyer – the person buying the home just built – does not have to worry about their land being foreclosed upon if the developer fails to make payments on the rest of the available property. The loan release – or the payment towards the property – is paid off if the release of the lien documents occurs.

What Are Buydowns?

One term you may hear your home buyers discussing is a buydown. The goal of a buydown is to lower the interest rate on a loan for at least the first years of the mortgage. In some cases, it can extend throughout the lifetime of the loan. There are a few things that are unique about this type of financial component. Generally, the seller of the property, which is sometimes a home builder, will make a payment to the lending company on behalf of the buyer. This causes the buyer’s mortgage interest rate to be lower, and as a result reduces the mortgage payment.

Why would the home seller do this? Well, the seller increases the purchase price of the home in an effort to compensate for this cost. In most cases, the seller places these funds in escrow that helps to subsidize the loan during the applicable years. This reduces how much the buyer has to pay. This is often done for a period of one to five years. After that timeframe, the payments increase.

As an agent, you may not have too much to do with the loans themselves, but you may be able to negotiate this type of deal for a home buyer who really wants to purchase a home that’s just out of their financial comfort zone. This type of transaction is often done with builders who want to sell property at the highest price point possible and quickly.

How Do Construction Loans Work?

Building a home is an expensive process and one that requires unique financing. Construction loans are available from many lenders. There are two main types. First, a construction to permanent loan is a form in which the lender pays for the construction and then rolls that cost into a traditional mortgage once the home is complete. This is the most common types of construction loan used today.

A second option is called a stand-alone construction loan. Here, the lender will advance the money for the construction of the home. Then, once the construction is complete, the home buyer obtains a mortgage to pay the construction debt. The big difference here is that with a construction to permanent loan, there’s just one closing process (which translates into lower costs).

If you are working with a builder or a home buyer who wants to purchase new construction, it will be important for them to seek out a construction loan, not a traditional loan for the process. And, not all lenders offer them. Those that do will likely pay out the funds from the loan in payments corresponding with the actual completion of various phases of the construction process. These lenders must approve not only the buyer’s financials, but they also want to approve the home plans (to ensure they are valued at the proposed amount to be lent) as well as the integrity of the builder.

Wrap Around Loans – What’s That?

You may come across situations of wrap around loans. This is not an uncommon type of loan. They are more common with homes that have a current outstanding loan on them. In this situation, the seller will lend the home buyer the difference between what the existing loan’s balance is and the purchase price of the home.

More clearly, this is a type of secondary financing. The seller of the property will provide a junior mortgage on the property which “wraps around” the current loan.

This is a type of owner financing. Most of the time, these loans will require consent from the current lender. The buyer will make loan payments that are enough to repay the existing loan as well as the seller’s loan to the home buyer. In some cases, the buyer’s payments will be sent to the lender instead of the seller. The lender would then forward the buyer’s payment to the seller. In this situation, the home owner is able to charge a higher interest rate to the buyer.

This type of loan is obtained in situations where the home buyer cannot obtain a traditional loan. It allows for buyers to enter into a secondary way of buying a home, though it tends to be more expensive.

What Are Package Loans?

A package loan is another type of mortgage financing the real estate agents may come in contact with during the sale process. This type of loan is used when a buyer wishes to purchase real property and personal property in one transaction.

For example, the home buyer wants to buy a home as well as the appliances, furnishings, and other items within the structure. Package loans combine these types of purchases into one loan. It’s a fairly straightforward financial instrument. One of the most common times that this type of financing may apply is during the purchase of a new home. A home builder may sell the home with all of its appliances, window coverings, and other components. In doing so, this raises the home’s value.

However, it is important to distinguish this term from loan packaging, which is the process lenders use to bundle mortgages from many people and sell them as investments.

Overall, the financial process of purchasing a home is rather complex when you consider each of these financial tools. As a real estate agent, the goal is to help the home buyer to find their home and then to buy it with the most affordable product possible.

While real estate agents do not handle the financial process, they do need to know what the home buyer needs in order to secure the right monthly payment. And, with numerous financial models becoming available especially through owner financing, it’s important to understand the impact on the agent’s role.

Key Terms

Blanket Mortgage

A type of loan used to fund the purchase of more than one piece of real property. A blanket mortgage is often used for subdivision financing.

Buydown

Obtaining a lower interest rate by paying additional points to the lender.

Construction Loan

A loan secured by real estate which is for the purpose of funding the construction of improvements or building(s) upon the property.

Package Mortgage

A method of financing in which the loan that finances the purchase of a home also finances the purchase of personal items such as a washer and dryer, refrigerators, stove, and other specified appliances.

Wrap-around Mortgage

A form of secondary financing for the purchase of real property. The seller extends to the buyer a junior mortgage which wraps around the existing in addition to any superior mortgages already secured by the property.

15.6 Usury Laws in Georgia

Transcript

In this lesson, we will briefly cover the usury laws in the State or Georgia. Usury laws govern the maximum interest rates that may be charged on loans.

In 1983, Georgia made broad changes to its usury laws. As a result of those changes, the Georgia Department of Banking and Finance no longer set a maximum interest rate for loans. However, six limitations were imposed. These include:

1) In a contract does not specify an interest rate, a maximum rate of 7 percent per annum will apply.

2) Loans under $3,000 cannot have an interest rate greater than 16 percent per annum.

3) Loans greater than $3,000 can have any interest rate agreed upon by the lender and borrower.

4) Loan origination fees or discount points for real estate related loans cannot be considered in the calculation of interest and are not subject to a rebate.

5) Unless agreed upon by the parties, a prepayment penalty cannot be applied to a loan. And;

6) A rate of interest advertised must be in terms of simple interest, or a rate stated in terms that would comply with the Federal Truth-in-Lending Act.

Key Terms

15.7 Sources of Loans - Primary Lenders

Transcript

Your job is to help home buyers find the homes they want. Before that can happen, your buyers need to arrange their financing first. How does that happen? It starts with saving money for a down payment and considering the various types of loans available to them. And, then, the question your home buyers want you to answer is often this: “Where should I get a loan?”

Of course, you do not want to provide your home buyer with very specific information (though some agents do work closely with mortgage brokers.) Rather, it is a good idea for you explain to your home buyer just how many options they have. And, they do have quite a few options. Today, there are numerous ways to tap into funding sources to pay for a home. Your buyer should consider them all and compare their costs, availability, and benefits.

Our goal here is to take a look at all of the loan sources that a typical home buyer has access to for the purchase of a home. Not each one of these loan source is available to all buyers. And, some do not provide loans directly. Also, in some cases, lenders may only offer a certain type of financing. If and when your home buyer talks to you about their loan options, it helps to know what the differences are. It can help you to educate your buyer. At the same time, it can give you some insight into what you can expect throughout the sales process from the lender.

So, where does the money come from?

One Option is a Savings and Loan Association

Savings and loan associations are no longer one of the largest sources of funds, but they remain a common option nonetheless. These are organizations that will accept savings at interest and they lend money to those savers mostly for the use of purchasing a home through a mortgage loan. Some offer checking accounts and savings accounts as well. Many also offer home improvement loans and investor-related loans.

These organizations are federally or state chartered. The types of loans and the options available to home buyers differs from one organization to the next, but there are a few things you should know about these organizations.

First, most of the time, these lenders offer conventional loans and they tend to favor single-family homes over other types of investments. FHA and VA loans are often available, but they tend not to be the main focus of these organizations. One of the key differentiating factors is that these loans are typically made locally. That means your home buyer will likely work with a small organization in the area rather than talking to someone across the country.

The loan terms vary but are typically 25 to 30-year loans. Loans can be made for up to 95 percent of the value of the property, though most of the time this is much lower at around 75 to 80 percent.

These are no longer your parent’s type of bank. Rather, they are growing to offer more flexibility and plenty of financing options for home buyers.

Commercial Banks Are a Second Lending Source

Many times real estate agents know much more about commercial bank loans because of their heavy advertising. It seems that your clients are likely to experience at least a few phone calls and direct mail campaigns as they buy a home from banks wanting to offer them a loan. There are thousands of commercial banks available and they offer most types of loans.

Many times, these organizations focus their efforts on construction loans or home improvement loans. These are typically short-term loans. They do offer longer term loans commonly sought by residential buyers.

These banks are federally or state chartered. Your clients could be working with a bank that’s located across the country. If the bank is a federally chartered institution, they generally can offer residential loans of up to 80 percent of the appraised value and usually not longer than 30-year terms. State-chartered banks are regulated as well.

Commercial banks often provide financing for shorter term loans, and focus less on permanently holding long term residential loans. However, they remain an affordable option for many home buyers today.

Then, We Need to Talk About Mortgage Companies

Mortgage companies are organizations that you could consider the middlemen. That is, they tend to help secure loans for larger financial institutions and then those lenders will go on to sell packages of loans as investments (more on that later). There are two main types of mortgage companies your home buyer is likely to come into contact with: the mortgage broker and the mortgage banker.

Let’s start with the Mortgage Broker.

This is not a direct supplier of capital, and that’s important to know. Mortgage brokers serve to bring the borrower and the lender together. They are paid a fee for their service that is typically equal to one percent of the amount of the loan (also known as origination points). This person’s job is to find the funding for a client based on their financial profile and need to borrow. One of the key reasons to work mortgage brokers is that they have a larger pool of options available that typical borrowers will not have on their own. An example would be insurance companies. Borrowers cannot contact an insurance company directly to obtain a loan. However, a mortgage broker can access this option for the borrower.

Now let’s talk about the Mortgage Banker.

This is a slightly different mortgage company and one that’s just as important. Bankers are also middlemen. However, these professionals go a step further in terms of what they offer. They can make mortgage loans as brokers do, but they can also package those loans together and then sell them to a third party investor. This includes selling them to back primary and secondary investors. The mortgage banker will continue to service the loan, even after it has been sold. This means the banker can continue to collect payments and pay property taxes for the home buyer.

When it comes to determining which of these is best for a home buyer, both options should be considered. Brokers are more likely to look at numerous options of lending for the home buyer, which can be beneficial especially if it is a high risk homebuyer. However, bankers make it easier to manage the transaction and they typically are more knowledgeable about the third-party’s needs.

Another way to look at the difference between the two is to see who is the individual that is working for in the transaction. The mortgage banker is working for the bank, who in turn, is the direct provider of the money for the loans. Brokers, on the other hand, are not representing just one institution but can shop around for the best loan for the buyer.

Credit Unions Are Another Funding Source

Many buyers today know what credit unions are, but do not know how to access them. Generally, the biggest difference between a traditional bank and a credit union is their business model. Banks are profit-driven and owned by large organizations. Credit unions are not profit-driven specifically but rather are owned by the members of the organization. Those members are the individuals who obtain loans and sign up for accounts there. There’s even a profit sharing component of their business.

Credit unions do offer mortgages. These loans are typically given only to those who are members of the organization. The credit unions determine the criteria for qualifying to become a member, such as being a member of a specific labor industry or religious organization. Credit unions often use mortgage brokers to help them find borrowers for their mortgage loan products. However, members can directly borrow from their credit union.

If your client is a member of a credit union, encourage them to go directly to their organization to inquire about a loan. Members can often secure low-interest mortgages through these affiliations that may not be available through third parties. Additionally, these lenders will charge less in fees if the broker is not part of the transaction.

Insurance Companies Are another Source

As mentioned previously, life insurance companies do fund home loans, but they do not do so directly to home buyers. They provide an important source of capital for the real estate industry, in fact. The hundreds of insurance companies available today often do their mortgage lending through local mortgage brokers as well as some mortgage bankers. Often, these organizations have large sums of investment opportunities available to them. It is common to find insurance companies, especially life insurance companies, investing in larger projects such as commercial developments or multi-family properties. As much as 30 percent of the assets of many insurance companies are related in some way to the real estate market.

The funds from these investors come from their premium charges to their clients as well as various investments. How can your borrower connect with an insurance company for a lending source? The fact is, they cannot do so directly. However, they can inquire about insurance investors through their mortgage brokers and/or bankers.

The bottom line is, your borrower does not necessarily need to worry about this type of funding source since few insurance providers will manage their loans. Insurance companies, like most other sources of lending, are governed by state laws. There are no federal agencies that issue charters to insurance companies.

Investment Groups Also Offer a Funding Source

Another route to funding comes from third-party investment groups. These organizations, like insurance companies, do not directly lend to the home buyer. Rather, they play the role on a lender where the mortgage banker manages the transaction. Nevertheless, investments are a source of lending on the real estate market and should be understood by home buyers.

A variety of investments place money in real estate related loans. These include pension funds, finance companies, real estate investment trusts, and others. For example, pension funds are a rather newer source of funding related to real estate. These organizations usually invest in stocks and bonds, but the strong reliability of real estate has led many in this direction. It is not uncommon to see pension funds adding capital to these loans. Most often, they invest in loan packages rather than single loans.

Real estate investment trusts, or REITs, are a common type of investment for real estate. The investors in the organization pool money together to purchase real estate. They work in much the same way as mutual funds. These are less commonly used for single-family home investments, though some REITs do offer funding for rental property.

It’s not uncommon to see individual investors provide a source of funding as well. Any number of people can come forward to provide a loan to those who wish to buy a home. Individuals who have available funds or groups of investors who want to pool their money to put towards larger property ownership, can often do so. While some individual investors provide funding directly to the borrower, most will work with mortgage brokers to find investment opportunities.

Considering all these loan options and properly educate your buyers so that they have a better idea who they should work with?

The answer isn’t always as clear as it may seem. Most often, real estate agents should offer guidance in answering questions about where to find a loan – such as through mortgage brokers, commercial banks, savings and loans, and credit unions. Yet, when the questions get a bit deeper, you’ll appreciate having some insight into what to tell your home buyer.

One key thing to inform your buyer about is that they do have flexibility and options. They are not directly tied to a single bank or lender. They should seek out offers from multiple lenders so they can compare options and find the offer which is going to fit them best.

Key Terms

Mortgage Banker

A person whose principal business is the originating, financing, closing, selling and servicing of loans secured by real property for institutional lenders on a contractual basis.

Mortgage Broker

A broker who arranges a mortgage loan between a lender and a borrower for a fee.

15.8 Financing Steps: Application and FNMA/FHLMC Uniform Procedures

Transcript

ow does one obtain a mortgage? There’s a great deal of planning and prep during the process, including comparing various lenders and home loan types. Yet, at the start of the actual process of obtaining a loan is the application process.

Real estate agents don’t handle this component of the home buying process themselves, but they do have to guide their home buyers towards the steps it takes to obtain a loan. As you face that buyer standing in your office and inquiring about the opportunities for purchasing a home, the first step will always be this question. “Have you filled out a mortgage application yet?”

Here, our goal is to talk about the specific application and what home buyers can expect during this process of applying for a home. It’s important to speak to your potential home buyers clearly and with accuracy. This process can take some time, requires a great deal of information about their specific needs, and will involve a variety of details about their personal financial health.

Let’s focus on the application process.

What Is the Uniform Loan Application and When Is It Used?

The 1003 mortgage application form, which is commonly referred to as the Uniform Loan Application, is the industry standard for applying for a home loan. Most mortgage lenders use it. It is rather basic, straightforward, and provides the information lenders need to make decisions. Some lenders will simply gather information from the borrower about his or her identity, the property itself, and other financial information and skip this formal application, but that’s far less common than using this application

The borrower must complete this document when he or she hopes to apply for a loan. It is done through the lender or mortgage broker. The borrower will complete this form two times. The first occurs during the initial request for the home loan. Once this form is complete, the lender can offer a loan to the borrower. It is completed a second time to verify the terms of the loan at the closing.

Because home buyers often fill out this form on their own, they should understand the details of it. While it is not the specific job of the real estate agent to complete this form, it is not uncommon for agents to receive inquiries about the details of it from buyers.

So, what is this form? It was first developed by the Federal National Mortgage Association, more commonly known as Fannie Mae. The Federal Home Loan Mortgage Corp., or Freddie Mac, generally require this form. These organizations purchase mortgages and hold them in investment portfolios or sell them as a mortgage-backed security. This process allows the lender to maintain liquidity of capital.

The mortgage application is specific because it provides the information that these organizations require. And, it is simpler for the home lender to provide the information in a templated manner like this.

What Information Is Needed to Complete the Uniform Loan Application?

Most often, your clients will complete the form over the phone or in front of a computer screen, but they’ll need to be ready to fill it out with a great deal of information.

What’s in the form? It provides all of the information the lender needs to have on hand to make a decision whether or not to lend to the home buyer. This includes information to verify the individual’s identity, employment information, and all financial information as well as information on the individual’s reliability. The form requires disclosure of a total monthly income for the home, a breakdown of expenses, and a detailed listing of all liabilities and assets owned by the individual. This includes stocks, bonds, retirement accounts and life insurance policies. It also includes any debts the individual has beyond what is included on his or her credit report. Borrowers must provide thorough and accurate information as it will be verified by the lender.

All of this information comes from the borrower. When completing the Uniform Application Form, the buyer’s credit report will serve as a backup to verify information, but the two products are separate documents. In other words, the buyer needs to take the time to completely fill out this document to ensure it is accurate and complete. The lender will then use property records, public records, credit reports, and much more to verify that the information is correct. The bottom line here is that your buyer needs to be thorough.

What Is the Application Process?

Here’s what generally happens. A home buyer requests a pre-qualification for a loan. The lender or mortgage broker asks for basic information and based on that information, the lender provides a ballpark figure of how much they are willing to lend to the buyer.

Once the home buyer finds his or her home to buy, the application process for the formal loan begins. Of course, it can start before this as well – as long as the home buyer knows he or she wants to buy a home, this document should be filled out and the loan process should begin. At this point, the lender will complete the Uniform Application Form and submit all information to the underwriters for approval. Once this is complete, your buyer’s information will be verified, credit scores will be considered, and loan offers can be made.

It is not until this point, though, that your home buyer is pre-qualified for a home loan. That’s important to you, as a real estate agent, because it ensures your home buyer really does have the financial means to purchase a home. While most real estate agents work with buyers who have basic pre-approval, pre-qualified buyers are best for submitting bids on homes because it shows home sellers that the buyers are serious.

The application process doesn’t necessarily take long – remember these mortgage brokers and lenders want to secure the business of the client, if he or she is well qualified. Within a matter of days or up to a couple of weeks, the buyer knows whether or not they’ve been pre-qualified for a loan.

Key Terms

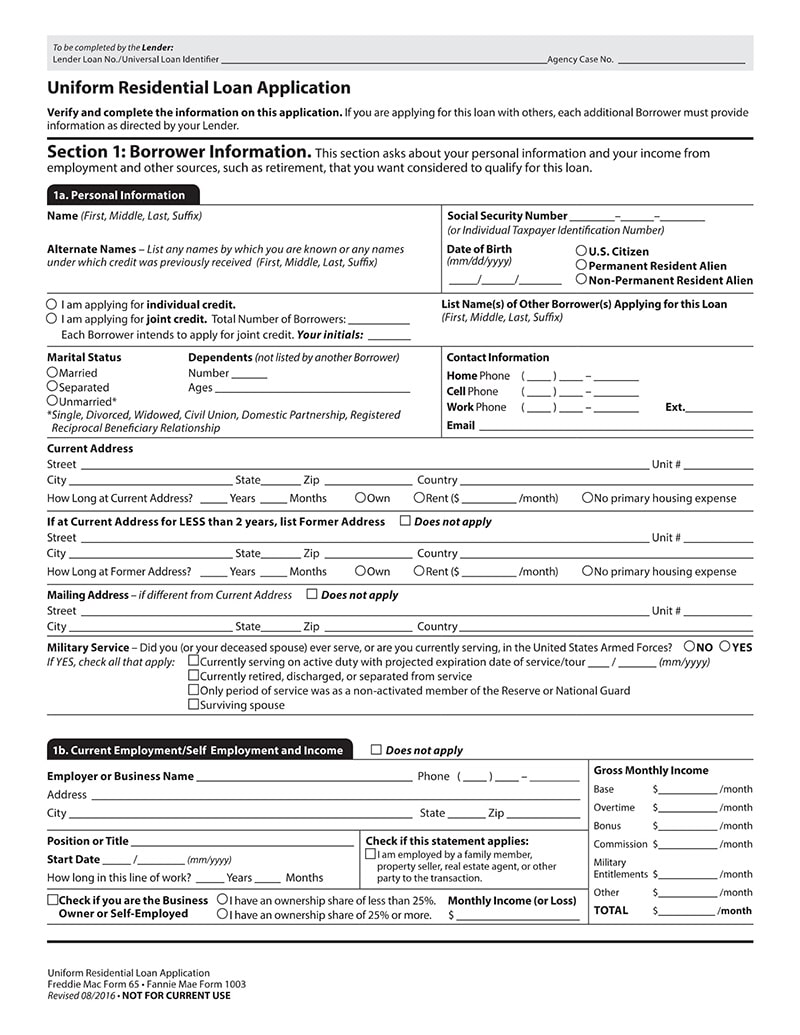

15.8a Uniform Residential Loan Application

Please spend a few minutes reviewing the document below.

15.9 Financing Steps: Qualification Process

Transcript

Those who wish to buy a home often make their first step a visit to a real estate agent’s office. That’s a good thing, of course, because it means they’ll soon begin working with you. Then, you learn they have yet to speak to a lender. They say they know how much they want to spend, but they haven’t gone through the legal process yet. What should you do?

First, let’s be frank. You should not immediately begin showing an unqualified home buyer homes. It is a waste of your time, that of the home seller, and even others involved in the purchase process. That sounds harsh, but it is important to make every connection matter during the home buying and selling process.

Second, a formal discussion with your home buyer can give them the information they probably need. Don’t be afraid to welcome them in, ask them to sit down, and talk about their goals and dreams. And, when they tell you they haven’t spoken with a lender yet, that’s okay. Tell them what will happen, how long it takes, and that you are ready to help them as soon as they move forward on the financial side of the process.

Now that you’ve said that, you may be asking what to expect.

Agents need to encourage their home buyers to become pre-qualified. Pre-qualification is one of the first indications you have that the home buyer is serious about the purchase. It also means there’s a lender that is most likely willing to help them through the process. As your clients sit down to inquire about what’s on the market, talk to them about becoming pre-qualified and what they can expect once they do.

Be sure to inform them that this is the first step. And, it doesn’t mean that your buyer is ready to make a purchase or that he or she should even place a bid. Nevertheless, a pre-qualification letter is the place to start.

So, what is a pre-qualification letter?

A pre-qualification letter is a document provided by the lender that the buyer has gone through either a basic or a more extensive process. The letter will be addressed to the agent or in general. It will state that the individual has been pre-qualified for a loan and outlines the mortgage value (up to $200,000, for example). The lender will specifically state that this is neither a promise of a loan nor that the borrower is qualified for a loan yet.

When you obtain these letters, you’ll notice they provide contact information for the lender. It’s not always your place to give them a call (though some home buyers will prefer that you do if you have questions about how much they can borrow or the prequalification itself).

What does this letter mean, then?

It doesn’t provide for much. It gives you a starting point from which to look for a home for the buyer to select. Pre-qualification letters don’t hold much weight because the lender has only used very basic information about the buyer to calculate this information.

A simplistic way to look at pre-qualification is this. At this point, the buyer has told the lender his or her financial information. They have told the lender how much they can afford and what their expenses are. None of this information is verified at a high enough level to make the underwriters of the loan satisfied. Your buyer may have given permission to have their credit history pulled, supplied income statements, and provided information about their expenses – but this hasn’t yet been verified. Based on the information supplied only from the buyer, the lender agrees it is likely to offer a loan pending further review.

Sometimes, not even that in-depth of information is obtained at this point. In fact, most of the time these pre-qualification letters are done online or over the phone. Most often, the borrower hasn’t completed a formal application and perhaps filled out a form online. Simply, this is the way for the lender to begin gathering information and enticing the home buyer into a loan. The hard leg work has yet to begin.

From the real estate agent’s point of view, it does not mean much at all, unfortunately.

The pre-approval letter comes next.

After sending the pre-qualification letter, the lender is likely to wait for the borrower to agree. That is, the borrower says, “Okay, I would like to continue being considered.”

Now that the lender has some basic information about the home buyer, they can begin to work the process. If your buyer is serious, they are working on this step long before you actually begin showing properties to them. The pre-approval process is more in-depth.